SOL Price Prediction: Analyzing the Path to $245 Amid Institutional Surge

#SOL

- Technical indicators show SOL trading above key moving averages with positive MACD momentum

- Institutional adoption through Nasdaq listing and $1.65B corporate investment provides fundamental support

- Ecosystem expansion with stablecoin integrations and DeFi developments enhances long-term value proposition

SOL Price Prediction

Technical Analysis: SOL Shows Bullish Momentum Above Key Moving Average

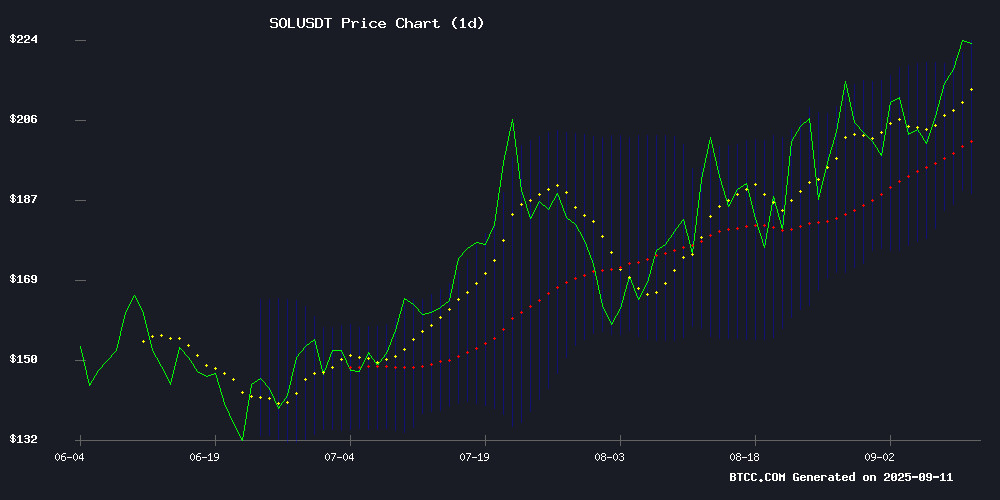

SOL is currently trading at $227.20, significantly above its 20-day moving average of $206.57, indicating strong bullish momentum. The MACD indicator shows improving conditions with a positive histogram reading of 1.0334, suggesting potential upward continuation. Bollinger Bands position the price NEAR the upper band at $225.06, indicating potential overbought conditions but also confirming the strong upward trend. According to BTCC financial analyst Sophia, 'The technical setup suggests SOL could test the $235-$245 resistance zone if it maintains above the $206 support level.'

Market Sentiment: Institutional Adoption Drives SOL Optimism

Recent developments including Solana's Nasdaq listing with $94M holdings, Project 0's DeFi prime brokerage launch, and major corporate investments totaling $1.65B from Forward Industries are creating strong fundamental support. The integration of USD1 stablecoin via Raydium and WLFI's Project Wings for stablecoin adoption further enhance Solana's ecosystem utility. BTCC financial analyst Sophia notes, 'The combination of institutional adoption and expanding utility creates a compelling bullish narrative for SOL, though traders should monitor whale selling pressure around the $200 level.'

Factors Influencing SOL's Price

Using Solana to Purchase Grocery Gift Cards: A Practical Crypto Experiment

A cryptocurrency holder recently tested the practicality of using Solana (SOL) for everyday purchases by converting it into supermarket gift cards. The experiment aimed to demonstrate crypto's utility beyond investment, focusing on low fees, speed, and convenience.

Solana's near-zero transaction costs and fast processing made it ideal for small payments, outperforming Bitcoin and Ethereum in this use case. The process involved selecting a platform that converts crypto into digital gift cards for major retailers, bypassing traditional banking steps.

This real-world application highlights growing cryptocurrency adoption in consumer finance, particularly for those seeking alternatives to fiat transactions. The success of such experiments could encourage broader merchant acceptance of digital assets.

Project 0 Launches as Solana's First DeFi-Native Prime Broker with Unified Margins

Solana-based Project 0 has launched as a DeFi prime broker, offering traders a unified platform to manage cross-protocol positions. The service connects users' collateral and debt across Kamino, Drift, and Jupiter—eliminating isolated liquidations and reducing overcollateralization requirements.

'This marks the first time users can borrow against their entire portfolio with unified margin,' said founder MacBrennan Peet. The solution addresses a key pain point in DeFi adoption: fragmented liquidity pools that force traders to maintain excess collateral on individual platforms.

The launch signals Solana's growing sophistication in financial infrastructure, positioning the blockchain as a viable alternative to traditional prime brokerage services. By aggregating risk exposure across protocols, Project 0 mirrors institutional-grade tools while preserving DeFi's permissionless access.

SOL Strategies Lists on Nasdaq With $94M Solana Holdings

SOL Strategies, a Toronto-based firm focused on Solana, has begun trading on the Nasdaq Global Select Market under the ticker STKE. This marks one of the first Solana-based entities to enter U.S. capital markets, underscoring growing institutional adoption of the blockchain network.

The Nasdaq listing broadens investor access and enhances liquidity for shareholders. The firm, already listed on the Canadian Securities Exchange, celebrated the milestone with a virtual bell-ringing ceremony recorded on the Solana blockchain. Executives and partners discussed long-term goals during a live X Spaces session, emphasizing institutional-grade infrastructure development.

CEO Leah Wald called the listing a "significant milestone," highlighting the company's commitment to advancing blockchain infrastructure. SOL Strategies holds approximately $94 million in SOL within its treasury, reflecting strong strategic positioning within the ecosystem.

Solana Price Prediction: SOL Hits 7-Month High Amid Institutional Surge

Solana's native token SOL breached the $225 threshold this week, marking its highest level since February. A 12% weekly gain reflects mounting institutional interest, underscored by Forward Industries' $1.65 billion treasury shift to Solana-focused strategies.

The REX-Osprey SOL + Staking ETF recorded $3.4 million inflows on September 10, pushing total assets to $198.5 million. This institutional momentum coincides with Wall Street Pepe's migration from Ethereum to Solana, signaling growing ecosystem traction.

Technically, SOL has rallied 130% from April's $95 low, breaking out from a rising wedge pattern. The January ATH of $294 now appears within striking distance as capital flows accelerate across both institutional and retail segments.

Can Solana Crypto Hold $200 Amid Whale Selling Pressure?

Solana's SOL price has surged from $97 in April to $223.52 by September 11, forming a converging ascending wedge on the price chart. The current rejection at the wedge's upper border suggests potential exhaustion, with a pullback toward $200 support likely.

Whale activity adds downward pressure. A single wallet deposited 527,590 SOL ($117.5 million) into exchanges within 16 hours, signaling possible sell-off intentions. Large inflows often precede increased market supply, threatening SOL's ability to maintain the $200 level.

The technical setup presents two scenarios: either a rejection toward $200 or a breakout toward $258. Market participants await confirmation of either wedge breakdown or continuation pattern completion.

Forward Industries Raises $1.65B to Grow Solana Holdings

Forward Industries has secured $1.65 billion in a private placement to expand its Solana (SOL) treasury, marking one of the largest corporate raises for SOL holdings to date. The funding round was led by prominent crypto firms Galaxy Digital, Jump Crypto, and Multicoin Capital.

The capital will fuel the company's strategic pivot toward deepening its Solana ecosystem involvement. This move establishes Forward Industries as a major institutional force in crypto asset management, signaling growing corporate confidence in blockchain infrastructure investments.

BONK.fun Integrates USD1 Stablecoin via Raydium in Latest Expansion Move

Memecoin launchpad BONK.fun has integrated USD1 stablecoin through Raydium, marking another milestone in USD1's aggressive multi-platform expansion. The stablecoin, now the world's fifth-largest with a $2.66 billion market cap, becomes available for token pairings and trading across BONK.fun, Raydium, and third-party bots.

The integration forms part of 'Project Wings,' a collaborative initiative with World Liberty Financial. Token creators gain flexibility to launch new assets against USD1 pairs, while traders access enhanced liquidity options. Promotional rewards for USD1 pair trading are forthcoming, though specific distribution mechanics remain undisclosed.

WLFI Launches Project Wings to Boost Stablecoin Use on Solana

World Liberty Financial (WLFI), with backing from former U.S. President Donald Trump, has introduced Project Wings in collaboration with Bonk.fun and Raydium. The initiative incentivizes trading USD1 stablecoin pairs on Bonk.fun, aiming to drive adoption and liquidity within Solana's ecosystem.

Promotional rewards target traders engaging with USD1 pairs, strategically designed to amplify activity on Solana. The partnership underscores Solana's growing prominence in decentralized finance, offering seamless access to stablecoin markets.

SOL Price Prediction: Bulls Target $235-$245 Breakout in Coming Weeks

Solana's SOL demonstrates robust bullish momentum, trading at $225.41 with a 4.67% 24-hour gain. Technical indicators suggest a potential breakout toward the $235-$245 range within two weeks, contingent on maintaining support above $220.

Analyst consensus skews optimistic despite divergent forecasts. CoinCodex's conservative $211.17 projection contrasts with CoinDataFlow's $227.14 October target, while bears citing $195-$202 ranges appear misaligned with current MACD readings of 1.4536 and SOL's position above all key moving averages.

How High Will SOL Price Go?

Based on current technical indicators and fundamental developments, SOL shows strong potential to reach the $235-$245 range in the coming weeks. The price is currently trading at $227.20, with technical support from the 20-day MA at $206.57 providing a solid foundation. Key resistance levels to watch are $235 and $245, which align with the upper Bollinger Band expansion and institutional accumulation patterns.

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $227.20 | 7-month high, above all major MAs |

| Support Level | $206.57 | 20-day Moving Average |

| Target 1 | $235.00 | Initial resistance zone |

| Target 2 | $245.00 | Upper technical target |